The Future of CRM in Banking - Key Trends to Watch

The banking sector is undergoing a major transformation. Customers now expect more than just secure transactions. They demand personalized, seamless, and intuitive digital-first experiences. To remain customer-centric and stay ahead of their competition, financial institutions are focusing on trends that contribute to exceptional customer experiences (CXs).

The key to this transformation is customer relationship management (CRM) systems. Modern CRM systems help banks use data to better understand customers and deliver customized solutions. Leveraging advanced analytics and AI-driven insights, CRM systems empower banks to anticipate customer needs, improve customer experiences, and build loyalty. The demand for such intuitive, modern services is pushing the banking industry to upgrade its legacy systems.

According to Allied Market Research (2024), the global market for banking CRM software is projected to grow at a 15.7% CAGR from 2021 to 2030, reaching $39.2 billion.

Beyond 2025, key trends like AI in banking CRM, predictive analytics, and personalization will majorly affect how banks look at customer experiences.

5 Key CRM Trends Transforming CRM in Banking

The latest wave of CRM adoption is creating real-time 360-degree views of customers. This enables banks to deliver personalized experiences at every stage of the customer journey. The following key trends are shaping the future of CRM in banking.

Leveraging Generative AI (GenAI) in CRM

GenAI provides CRM systems capabilities beyond traditional analytics and automation. GenAI-powered CRM improves productivity and innovation by using customer data to deliver insights that are more accessible and actionable. Banks use AI models like GPT to analyze data and offer services like financial advice, next-best-action recommendations, and customer support.

GenAI copilots help summarize cases, create knowledge content, draft proposals, emails, and service replies. They also explain data trends and uncover new insights, enabling faster decisions. Integrating conversational AI interfaces improves how users interact with CRM data and processes, leading to intuitive and seamless engagement. Moreover, CRM vendors are expected to expand their offerings with specialized or diverse large language models (LLMs) tailored to specific industry needs. These models would be tailored to address unique industry needs, such as legal operations management (LOM) for legal firms, loan origination and management (LOM) for banks, or location operations coordination (LOC) for logistics companies. These models would enable more precise and relevant insights, recommendations, and automation specific to each industry.

Ally Bank aimed to enhance agent productivity by minimizing manual tasks and prioritizing the customer experience.

Success Story: Ally Bank partnered with Microsoft Azure’s OpenAI service to create a tool that generates summaries after customer calls. What was once a manual task now delivers real-time summaries for over 700 associates. The tool has reduced post-call efforts by 30%, with a projected reduction of up to 50%. It currently achieves 85% accuracy and continues to improve.

This implementation of GenAI has resulted in significant time savings and operational improvements, with the reduction in post-call efforts allowing associates to focus more on direct customer engagement.

Consolidating Vendor Platforms

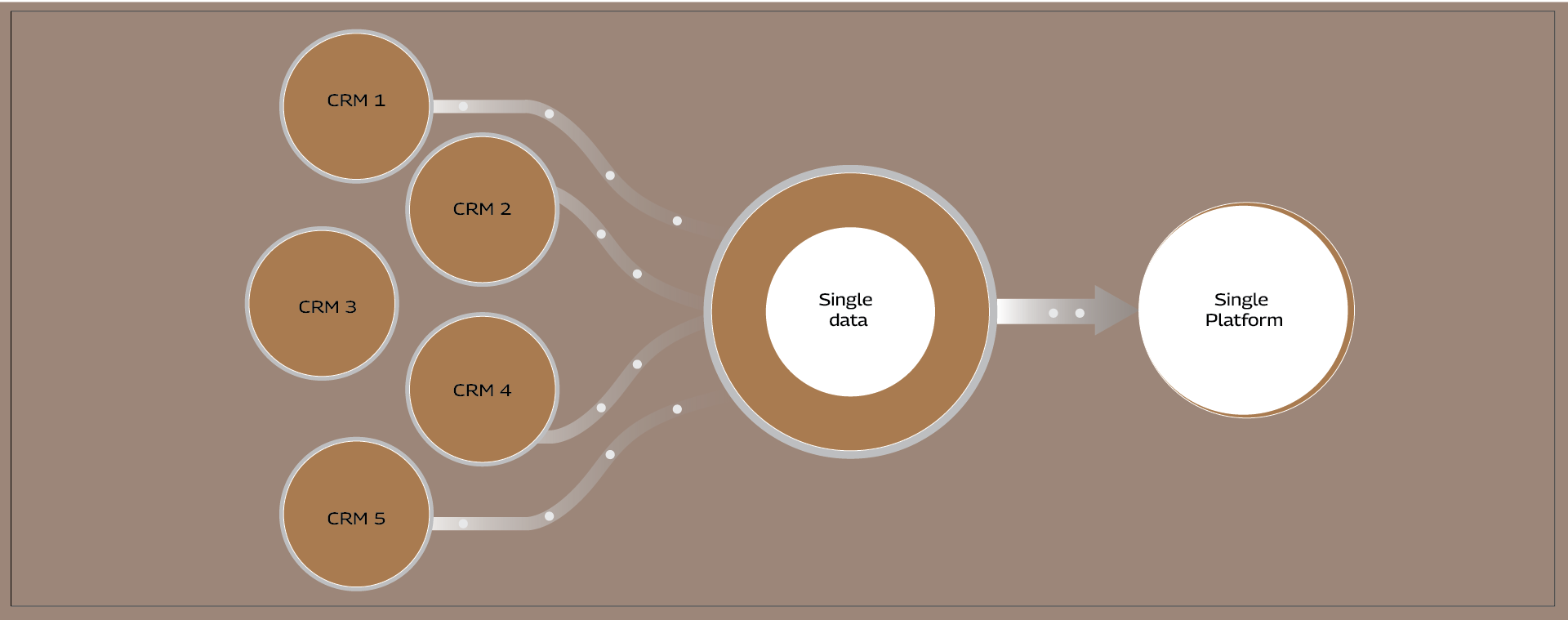

CRM Platform Consolidation

Large organizations often rely on multi-vendor, disparate CRM systems across various departments. For example, sales, marketing, or finance teams may have their own systems in place. This leads to fragmented data and inefficiencies. Consolidating these platforms provides a unified customer view, reduces license wastage, and streamlines operations.

A unified customer-centric CRM allows companies to manage their customer data more effectively from the first touchpoint to revenue recognition, with a comprehensive view of their customers.

Success Story: As part of a major CRM transformation, National Australia Bank (NAB) merged 13 legacy systems into a single, world-class Salesforce CRM platform. This new platform, which combines internal as well as external vendor systems, allowed NAB to deliver rapid changes and improve user experiences across the organization.

With this consolidated CRM system, NAB is now able to gather better insights, deepen customer relationships, and deliver faster services.

Expanding Beyond Traditional CRM

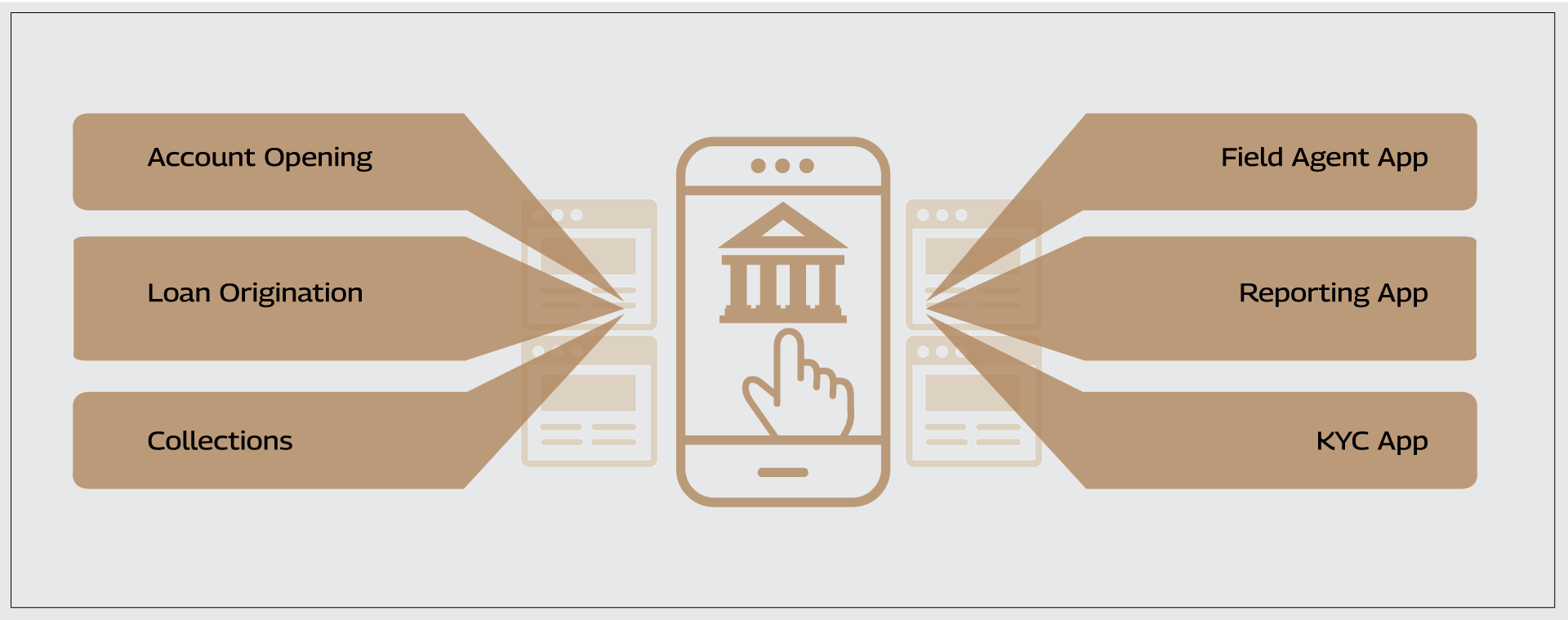

Low Code Capabilities of CRM Platform

Modern CRM systems are evolving to offer more than just traditional customer relationships or data management. Vendors now provide packaging solutions that help firms deliver better customer experiences beyond customer service, marketing, and sales. Many financial services CRM solutions, such as Microsoft and Salesforce, are building functionalities that extend beyond core CRM, such as account opening, intelligent workflow automation, customer revenue management, and employee collaboration tools. Low-code and no-code platforms empower businesses to build custom workflows without IT support.

Success Story: Housing Development Finance Corporation (HDFC), India’s largest private sector bank, replaced 25 applications by integrating functionalities like digital account opening and loan origination into a unified financial services CRM. In addition to CRM implementation, HDFC built several other applications on the same platform, including instant digital account opening with eKYC, video KYC, loan origination with credit decisioning, relationship manager app, and reporting application. These innovations, powered by advanced AI, improved both operational efficiency and customer experiences.

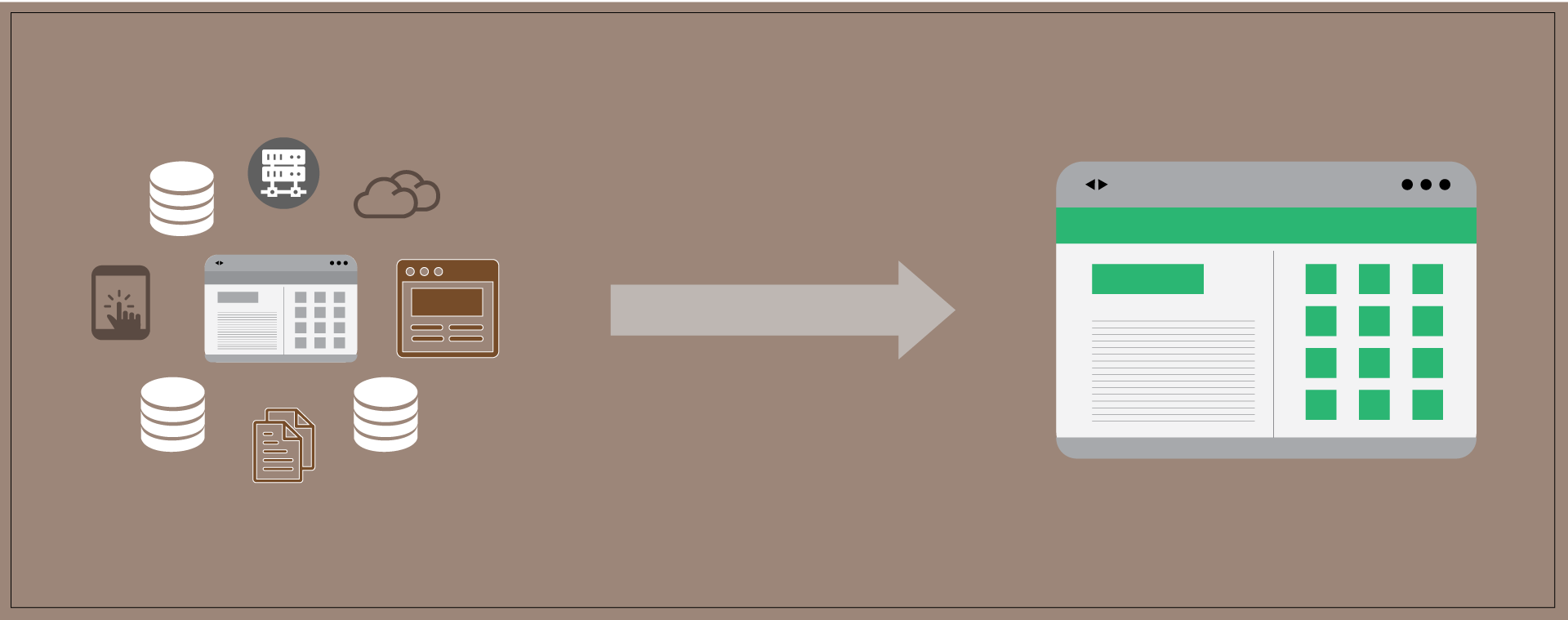

Building a Data-Driven CRM Strategy

CRM Data as Single-Source-Of-Truth

Data is the backbone of every successful CRM strategy, but poor data management can significantly hinder its potential. Bad data costs businesses an average of $15 million annually. Disjointed data across multiple CRM systems leads to inefficiencies and erodes trust. A data unification strategy bridges silos, enabling personalized interactions and actionable insights.

By unifying all customer data, such as online reviews, customer service records, browsing behavior, and purchase history, organizations can better understand and serve their customers. Additionally, securely activating this data across CRM systems can power AI-driven insights, driving exceptional customer experiences.

Success Story: A leading mortgage lender faced challenges due to siloed data spread across touchpoints like call centers, email, and text messages. This disparate data prevented the company from recognizing each customer’s unique journey and immediate needs. They established a centralized data repository, implemented identity resolution, and created golden records to address these issues. These steps unified their data, providing actionable customer data insights and reducing customer churn, ultimately helping them understand the customer journey better.

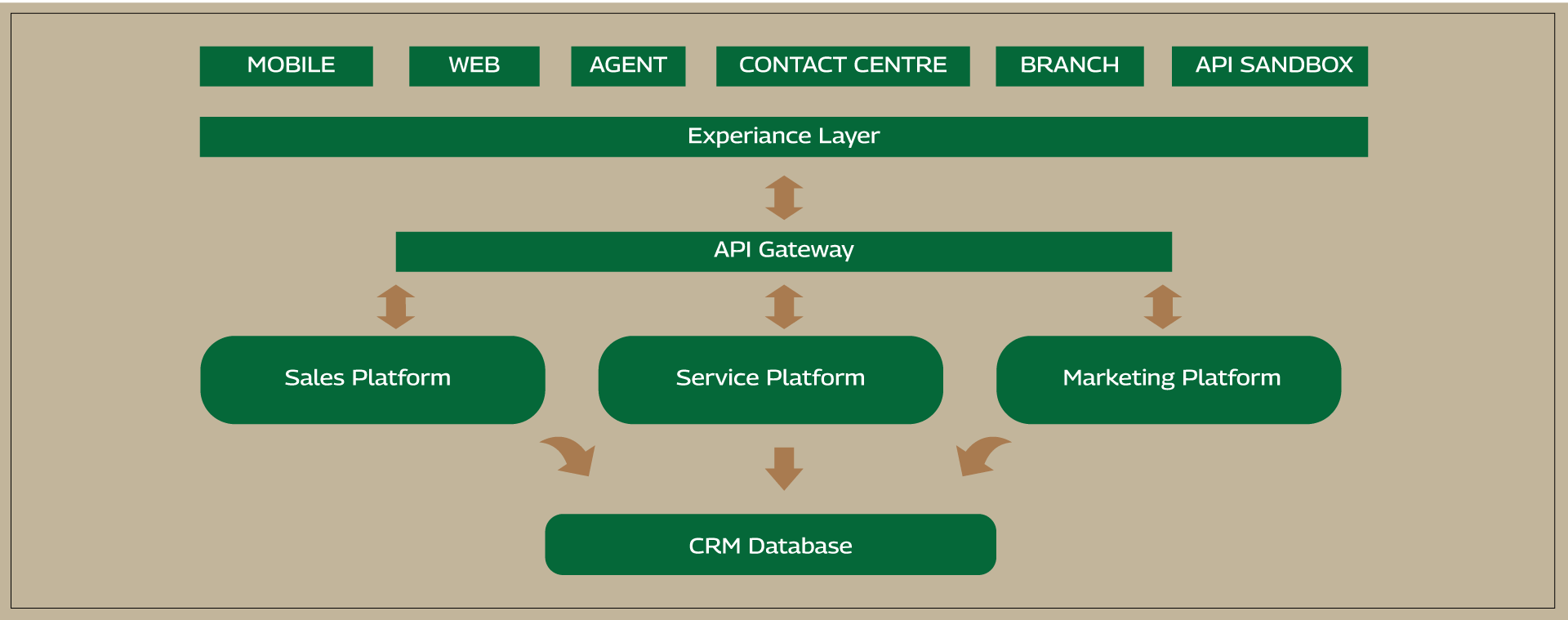

Customer Centricity with Headless CRM

Common Experience Layer for Multiple CRM Systems

Headless CRM separates data storage from presentation layers, offering unmatched flexibility. APIs allow organizations to connect CRM systems to any front-end application, delivering personalized experiences.

In the financial services sector, the traditional CRM approach may not be sufficient for large enterprises striving for sustainable growth and differentiation. As a result, many enterprises are moving toward abstracting the customer engagement layer out of CRM systems or using best-in-class AI models to process vast amounts of data from both internal and external sources. Over time, these enterprises are likely to rely on technology suites built from the best-in-class point solutions offered by specialized vendors rather than sticking to a single CRM provider.

Conclusion

The future of CRM in banking is more than just technology. It’s about meeting and exceeding customer expectations. The next generation of CRM systems will optimize internal processes while creating a more responsive, personalized, and efficient customer journey. By investing in AI-driven analytics, flexible architectures, and data unification strategies, banks can deliver great value to customers and drive growth in a competitive market.

To learn more about how Tech Mahindra can help ,visit https://www.techmahindra.com/services/artificial-intelligence/generative-ai/.

Endnotes

- Allied Market Research. (2024, December 12). Banking CRM software market: Global opportunity analysis and industry forecast, 2023-2032.

- Microsoft. (n.d.). Ally Bank uses Azure to transform banking and improve customer experience. Microsoft.

- ITNews. (2024, December 9). NAB commits to massive CRM transformation. ITNews.

- Business Next. (n.d.). HDFC bank’s approach to digital transformation. Business Next.

- RedPoint Global. (2024, May). Mortgage lender reduces churn with customer-centric CRM solution: A case study. RedPoint Global.

- Gartner. (2024, January 3). How to create a business case for data quality improvement. Gartner.

Rajendran Murthy is a subject matter expert in customer experience transformation. He has 25+ years of experience designing, implementing, and optimizing strategies for CX solutions and has helped numerous organizations elevate their customer journeys. He specializes in delivering client-centric solutions for digital banking and customer connectivity products within retail and corporate banking domains.