Challenges and Opportunities with AI Adoption in the BFSI Sector

In January 2025, the Hyderabad Software Enterprises Association (HYSEA), representing 90% of Hyderabad’s IT and ITeS industry, partnered with Tech Mahindra for a roundtable hosted by the HYSEA Thought Leadership Forum. The forum empowers senior leaders by providing insights and resources to navigate today’s complex business landscape. The focus: complexities and opportunities around the adoption of emerging technologies, particularly AI, within the BFSI sector.

This discussion brought together industry leaders, regulators, and tech experts, including representatives from top banking and financial institutions across the US, Europe, APAC, and India with Global Capability Centers (GCCs) in the region. They shared insights on the current impact of these technologies on the financial sector.

Regulators are closely monitoring AI usage, acknowledging its potential risks and significant benefits. In 2022, Kevin Greenfield, then Deputy Comptroller for Large Bank Supervision at the OCC, testified before the U.S. House of Representatives Committee on Financial Services, Task Force on Artificial Intelligence. He stated that AI can assist banks with regulatory compliance, leading to improved safety and consumer protection.

This suggests that financial services firms can scale AI adoption effectively by prioritizing trust.

The Hurdles We Face

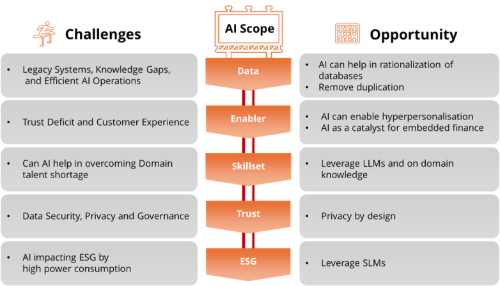

One of the strongest points raised was putting AI to work in BFSI isn't so straightforward. Several challenges came up in the dialogue:

Legacy Systems, Knowledge Gaps, and Effective AI Implementation

A recurring theme in the discussion was the challenge of integrating AI into the complex web of legacy, disparate systems that many financial institutions still rely on. These systems, often lacking adequate documentation and the expertise of their original suppliers, present a significant hurdle. Contextual AI offers a promising path forward, allowing firms to leverage AI for enhanced data analytics, automation, and security without requiring a complete overhaul of existing infrastructure.

Trust Deficit and Customer Experience

Trust deficit often hinders AI adoption. Misunderstandings about AI's capabilities, along with concerns about bias and "hallucinations”, can create resistance. Bridging this gap requires demonstrating the tangible benefits of AI. The forum highlighted the potential of advanced AI features like real-time predictive modeling, continuous learning, and hyper-personalization to deliver a "GAFA-like" customer experience, driving engagement and positively impacting the bottom line.

Talent Gap

The BFSI sector faces a persistent talent shortage, particularly in areas like compliance and innovation. The complexity of financial products and regulatory requirements makes attracting, retaining, and upskilling professionals a constant challenge. AI-based learning platforms, powered by LLMs, semantic models, and natural language generation, can help capture domain insights and accelerate knowledge transfer, mitigating the impact of talent shortages.

Data Security, Privacy, and Governance

Data security, privacy, and governance were identified as critical concerns. The sheer volume of customer data processed by BFSI institutions raises significant questions about data protection, compliance with regulations like GDPR, and the ethical use of data. A "Privacy by Design" approach, embedding ethical considerations and compliance requirements from the outset, is crucial, along with strategies like data minimization and segregation.

ESG Concerns and AI’s Environmental Impact

The environmental impact of AI, particularly the high energy consumption of LLMs, was a key point of discussion. The participants explored the potential of Smaller Language Models (SLMs) as a more sustainable alternative, offering comparable performance with lower energy consumption, thereby aligning AI adoption with ESG goals.

Turning Challenges into Opportunities

The panel also illuminated several key pathways for BFSI firms to leverage the transformative potential of AI and gain a competitive edge:

Tech as a Game Changer

The roundtable emphasized that technology, and AI in particular, is no longer just an operational enabler but a strategic differentiator. BFSI firms that effectively leverage AI can gain a competitive edge by improving customer experience, personalizing services, and developing new, innovative products.

AI-Driven Hyper-Personalization and Embedded Finance

AI enables hyper-personalization, empowering BFSIs to customize financial products and services to individual customer needs. Embedded finance, seamlessly integrating financial services into non-financial platforms, represents a major opportunity for driving deeper customer engagement and creating new revenue streams.

Automation and Agentic AI

AI-driven automation can streamline operations, reduce costs, and improve efficiency. The next evolution, Agentic AI, promises even greater autonomy, enabling AI systems to make decisions (within guardrails) and take actions without human intervention.

Industry-Academia Collaborations

The discussion emphasized the importance of collaboration between BFSI firms, regulators, technology providers, and academia. Academia can serve as a vital innovation hub, promoting research and development and providing a pipeline of industry-ready talent.

AI Adoption Beyond AI Development

While AI development is crucial, the real value lies in its strategic, widespread adoption. BFSI institutions should prioritize practical AI use cases that address specific business challenges and deliver measurable results.

The following illustration provides a quick summary of the challenges and opportunities identified during the discussion:

Conclusion

The HYSEA-Tech Mahindra roundtable at Hyderabad reinforced a shared understanding - while the transformative potential of AI in BFSI is undeniable, the path to sustainable AI success is long but exciting. Ultimately, BFSI firms strive for sustainable growth, enhanced customer loyalty, and operational excellence. While technology is crucial, the heart of BFSI remains the human connection.

Emerging tech like AI, when implemented thoughtfully, enhances these connections. By automating routine tasks and providing deeper insights, AI frees up human talent to focus on building relationships, offering personalized advice, and delivering exceptional customer service. AI’s speed, agility, and industry acceptance will determine its successful integration and its true promise lies in empowering humans to focus on deeper, more meaningful interactions.

Lakshmi Kanth has more than two decades of experience in the banking and financial services domain. He is a certified privacy specialist from DSCI. He is passionate about creating purposeful and innovative solutions for the BFSI vertical - solutions like RITA, CTEE, and data residency-as-a-service that stood out during launch. His deep domain skills and ability to map an outcome are his core strengths.

Aarsh is working as a Client Partner in India for Europe-based clients of Tech Mahindra. He completed his MBA from IIM Indore and joined the company as a part of the Global Leadership Cadre (GLC) batch of 2024. He is passionate about the financial services domain and likes to explore the intersection of IT and finance.