Outcome-based Pricing Model: The What, Why, and How

Did you know that a large electrical corporation in Europe provides a contract to a renowned international airport where they don’t sell lighting bulbs, instead they are contracted to ensure that they will keep the airport illuminated throughout? It’s a great model where in the seller owns end-to-end management of lightening requirements of the bulbs installed and airport authority only pays for the consumed services without worrying about the maintenance and energy aspect. Win-Win? Probably!

Through this post I would like to touch upon (what, why and how) the shift of demand curve of revenue from traditional model to new and more sought-for outcome-based pricing model

What?

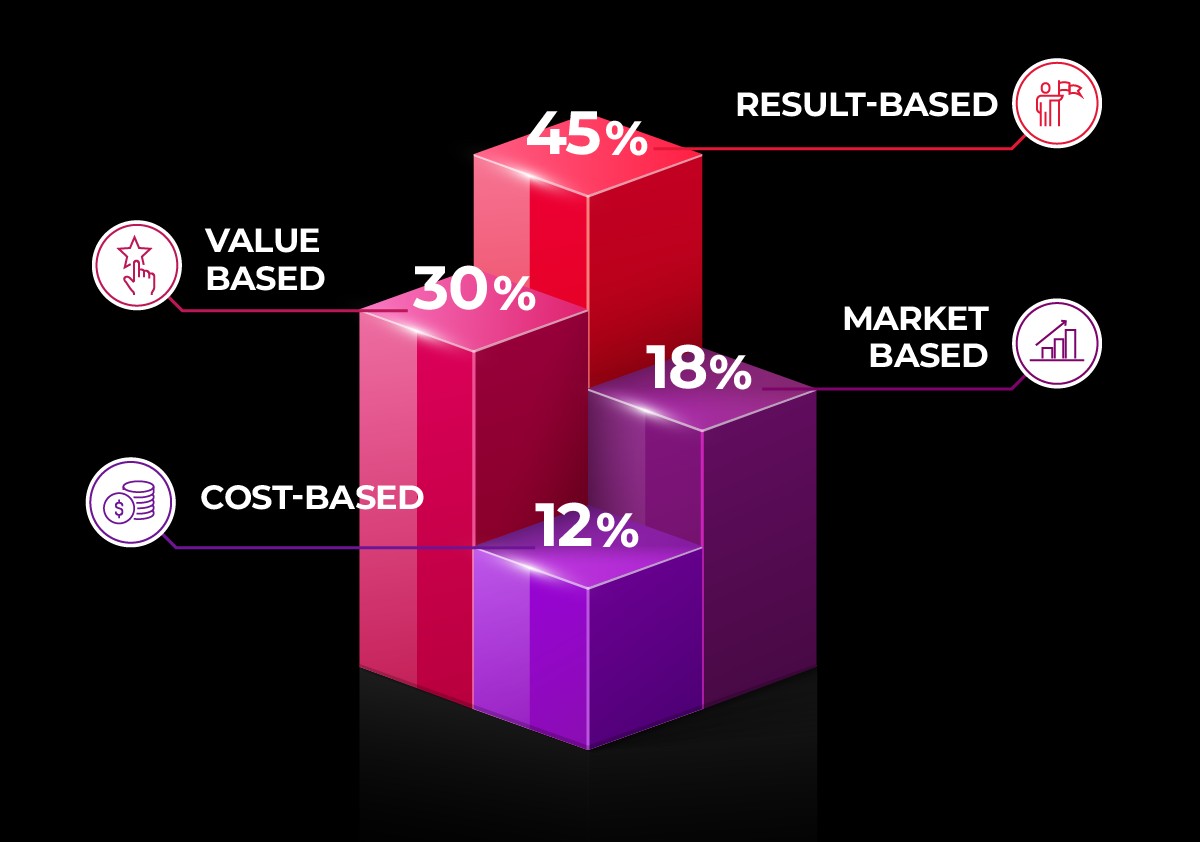

Some of the common and popular pricing models that we have seen over the years are cost-based, market/competitor-based and value-based. These are some of the traditional models that have helped most of the organizations to do business in yester-years.

Traditional pricing models have been focused on activity rather than productivity and worked great for organizations of the past with little digitization, legacy systems, minimal tools, and mostly human-driven services. However, with the advent of newer technologies, hyper-automation, and digitization the buyers want to offload the main limitation of traditional pricing models, which is a “risk to the buyer”.

The cost of services and return-on-investment calculation is very delicately balanced and has repercussions not only for the buyer (risk) but also the seller (profitability cap).

At Tech Mahindra, nearly 80% of our enterprise customers have discussed outcome-based pricing. Outcome-based pricing is when pricing factor is determined basis the value or product, and not the fixed-agreed cost, alone. Outcome-oriented pricing simply put is “reap what you sow” model, which is a fundamental shift in how pricing of future is going to be.

Why?

Factually, sellers have been charging buyers based on consumed services (in the context of projects executed or labor consumed). However KPIs and SLAs associated with them have failed to capture buyer’s alignment to services delivered, which means, although the delivery has been of utmost quality the applicability of the services hasn’t really resonated with buyer’s pulse. This added with volatility of technology and its trends resulted in input to output disparity.

Let’s look at some benefits that adoption of this pricing model brings along:

- The immediate tangible advantage is the differentiation that sellers can create for an often commonly used product and/or service that is able to generate specific outcome expected by the buyer

- Improved revenue pertaining to better pricing control methods

- Needless to mention, this brings about pricing flexibility where seller develops pricing mechanism exactly as per buyer’s needs.

- Finally, and the worthiest of mention is that the model ensures that both the buyer and seller are fully participated achieving a common desired outcome.

How?

While outcome-based pricing has its paybacks, it’s a bumpy road, nevertheless. The immediate roadblock is ascertaining the outcome and indisputably agreeing to the source of fruitful outcome. That is, stating that X led to Y. The next challenge encountered is end-to-end control. In an environment with multiple stakeholders and technologies (which is the most common scenario within buyer’s organization), it’s always tough to confirm with 100% certainty, that outcome was accomplished by one specific group, team, or technology. Finally, with above to points combined, it becomes a herculean task to agree and draft contracts that are both fair and clear. Which can further make it cumbersome to resolve any disputes, even with the best of partners. Furthermore, there are examples of organization which needed an overhaul to create an internal construct and re-align their internal capabilities like restructuring financial invoicing, adding new financial audits.

Tech Mahindra assists clients in creating, drafting contracts based on XLA’s. One good XLA that we have seen huge traction is the percentage of devices not reporting errors post patching. This as opposed to the multiple SLA’s earlier like percentage of devices patched, where devices not being patched would be attributed to multiple problems points and hence multiple teams, resulting in the final objective of the estate being secured made redundant.

Conclusion

There is a cut-throat competition in this cost-conscious, user-centric world, where buyer demands are ever-increasing, and sellers must re-invent ideas to woo new business and deliver quality services, at the same time. The applicability of the model may not be for every industry, customer or vertical, but when buyers are able to experience the value of seller’s product over a longer period, that gives sellers more opportunities to exhibit value.

Hence, it sometimes may not be in the best interest to make a quantum leap of entire outsources services to result-based pricing. Crawl-walk-run is the best bet where the winning proposition can really start with ‘hybrid pricing’ – traditional pricing amalgamated with result-based pricing. This would mean that the provider can at least break even on the services contract while buyer starts to observe benefits of service delivered. Eventually, they then can expand the realms of outcome-based pricing to align further imbursement with the achievement of business goals for additional set of agreed services. This eventual inclusion of services then can be expanded and evolved, to engulf multiple aspect of services into the outcome-based pricing model.

As they say, “Evolution is the secret for the next step.”

Akshay Patkar is Digital Workplace Evangelist and Architect based in Pune (Maharashtra). With over 11 years of experience in IT, he has been enabling customers to reap the value of their existing IT investments and bridging the gap between legacy and modern technology.